The concept of social justice, which politicians and revolutionaries are talking about these days, is vague and undefined in seeing how to distribute the income that is advocated in the media, including an implicit accusation of dishonesty or at least greed for those who make profits, and this coincides with a trend of public ownership and a return to the sector The public, even if it brings losses, desires equality in poverty, in order to achieve justice among people!!

Therefore, we must have a philosophy and a vision of justice before going into secondary procedures that may lead to the impoverishment of the whole society on the way to achieving this justice, and public spending and tax policies are one of the means of society to achieve the goals of achieving justice in society in a balance between the survival of the incentive for success and profit and spending needs The year I will explain in the next lines.

I see that there are two different philosophies dealing with social justice: the first philosophy deals with social justice as a result to be reached, regardless of the justice of the means, as did communism, and as some politicians claim in Egypt now, and the second philosophy deals with social justice as the justice of opportunity. Rewarding the effort, and at the same time providing certain services and rights to all, such as education, health care, public transportation, sanitation, and clean water, for example, regardless of income disparity, in addition to spending on justice institutions (the judiciary), the foundation for the defense of the homeland (the army) and law enforcement institutions (the police). It is the philosophy closest to my mind and conscience in achieving a known limit of rights, while at the same time rewarding work and acknowledging the plurality and difference of abilities and livelihood.

Investment in manpower and equal opportunities contribute to supporting economic growth and employment, and achieving social justice more than simply taking from the most capable of distribution at least the ability. Equal opportunities are achieved through spending on a basic education system that does not differentiate between the rich, the poor or the marginalized, a basic health services system that does not discriminate between classes, decent public transportation to work through investment in infrastructure, and a transparent business climate that prevents monopoly and protects small business owners and ensures them in the productive process and in creating decent job opportunities and generating incomes for their families. If the government plays its role in laying the bricks of equal and transparent opportunities available to all, everyone contributes through their work to achieving economic growth and income growth for all workers by reaping the fruits of economic growth in which all workers contribute – that is, a larger share of the pie for every diligent person.

Here we have to understand that achieving social justice in this sense falls on the whole state as an organizer and guarantor of rights and on the citizen who is able to use his money to create new job opportunities and the worker with his effort and mastery of his work to achieve more income and well-being for him, his family and society.

Such policies directed to achieving economic growth and social justice need huge resources, efficient management, and a clear vision for the state and policy makers. Here comes the role of the second corner of public finance policies, which is tax policies. Once again, economists face the problem of achieving economic justice through a system that is also fair to its payers and the effort of their work. Establishing an efficient and equitable tax system faces several challenges in developing countries where small businesses and informal businesses that do not contribute to paying taxes the largest share of the economy, in addition to the evasion of many self-employed people in light of a weak tax system that is not possible, and therefore unable to limit And official collection through receipts. For example, we will find in Egypt that less than ten percent of institutions pay more than eighty percent of taxes, not only because the collection system is inefficient, but because these individuals and small enterprises are outside the scope of the regulation and follow-up radar.

However, public spending on various activities aimed at empowerment, equal opportunities and social solidarity must be within the limits of the state’s capabilities, because spending without taking into account macroeconomic balances leads to inflation, a result that harms the poor more than the rich.

Taxes are not a goal in themselves, nor are they a punishment for the rich just because he reaps profits, and they are fair to the poor because they are used in the development of public services that allow the incapable a decent life, and equitable to the able because a decent life for all achieves social peace, and it should not be exaggerated and spend The incentive to work or cause the flight of investment and job creation. We must bear in mind that Egypt competes with other countries in attracting investment to the Egyptian market, because our own capacity, at least at the present time, will not be able to create one million job opportunities annually to accommodate the needs of the growing population (one million six hundred thousand new people annually is the number of births in Egypt ). The growth of investment and the collection of taxes from its profits contribute to the provision of services and a business climate that enables everyone to produce, innovate and grow. The higher the ability to work, produce and achieve profits, the higher the growth rates and the economic pie, and the tax base expanded due to the increase in the number of workers on the one hand, and the increase in incomes resulting from economic growth. Hence, it is clear that tax policy must achieve an optimal mix of economic efficiency and social justice.

In order to achieve justice, it is important to raise the efficiency of the tax collection management system, a matter that had begun to take place since the legislative amendment of 2005, which I began to notice in recent years and the return of pressures from tax collectors that had begun to disappear at the beginning of an era of trust between the tax authority and citizens. What will leak a lot of what is paid out of the legal framework of the state.

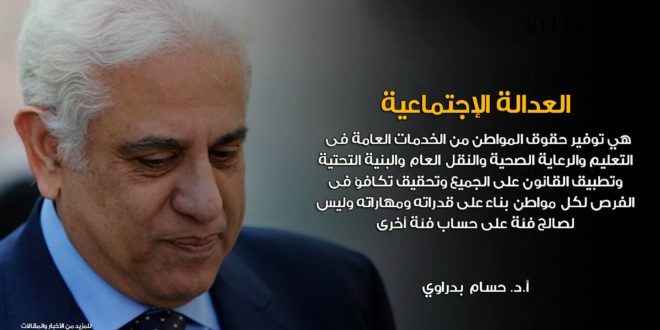

Social justice is achieved by providing citizens’ rights from public services, as I said, in education, health care, public transportation, infrastructure, law enforcement for all, and equal opportunities for every citizen based on

His abilities and skills and not just his presence. Everything I mention here needs funding from the community, efficient management from the government, and oversight of public spending in order to achieve its declared goals. If a government comes and installs excess employment or spends unrealized profits or arbitrarily to close a factory or production unit, then – and if it pleases a group of society – it has definitely violated the philosophy of social justice for all for the benefit of a group even if it has a right from our point of view and its view.

Through this article, I am not a specialist and I speak the language of the citizen who studies and scrutinizes what is being circulated politically on the scene. I wanted to share the opinion and understanding of phrases that are being circulated and explained without their meaning, which leads to the opposite of what is intended. How many crimes are committed in the name of social justice in Egypt.

This article was written with the participation of Dr. Amina Ghanem, Executive Director of the Egyptian National Competitiveness Council

* Founder and Honorary President of the Egyptian National Competitiveness Council

Dr. Hossam Badrawi Official Website

Dr. Hossam Badrawi Official Website